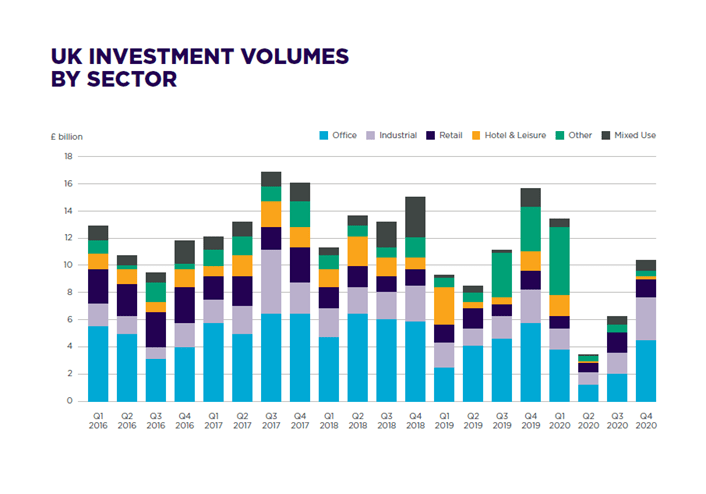

- Q4 2020 saw a total of £10.4 billion transacted across the UK commercial investment market, up by two thirds on Q3, when £6.3 billion changed hands. This takes investment for the whole of 2020 to £33.7 billion. Despite this bounce back, the Q4 and full-year figures remain below 2019, which saw £15.8 billion invested in Q4 and £45 billion across the year. Q4 2020 was down by 12% compared with the five-year quarterly average.

- Across the whole of 2020, the industrial sector has understandably been the most resilient, with investment falling by just 4% on 2019. This compares against a 69% fall in the hotel and leisure sector, a 31% reduction in office investment and an 11% fall in the retail sector.

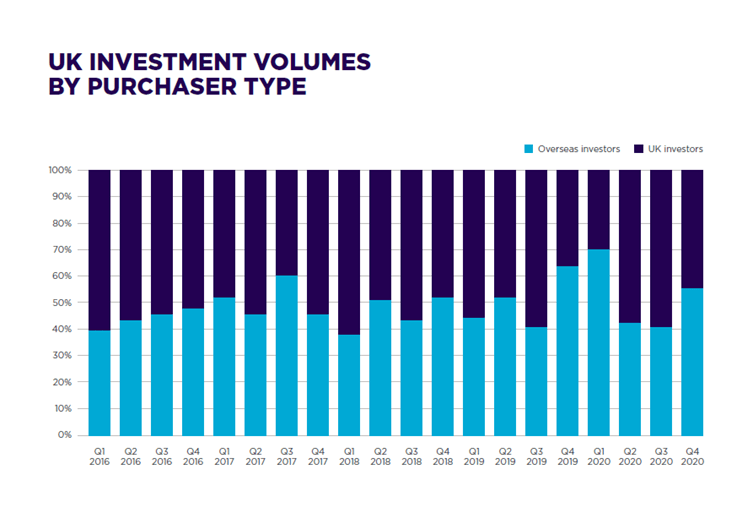

- Overseas interest has remained strong, particularly from European and far Eastern buyers, and accounted for 57% of the total investment value in Q4 2020 (and a similar 58% over the whole year).

- Overall, activity and investment volumes have shown considerable resilience given the context of the year, particularly as capital fund raising has been challenging with many investors continuing to delay decisions.

Our research specialists, working with our national and regional investment professionals, have released our UK Investment Quarterly report reflecting on Q4 2020.

The research includes a detailed review of commercial property investment volumes by sector and type of purchaser.

In the office sector, £4.6 billion traded between October and December 2020, comparing favourably against the £2.1 billion invested into the sector during Q3. A total of 13 deals, more than £100 million, were recorded of which nine were in London and 11 were acquired by overseas investors, the largest being Singaporean investor Sun Venture’s acquisition of 1 & 2 New Ludgate in London, EC4 for £552 million from Landsec, generating a 4% net initial yield for the purchaser. Another deal of note was the acquisition of a portfolio of 58 Government offices for £212.5 million by Elite Commercial REIT, a Singapore-based investment trust. The portfolio covers 1.3 million sq ft across the UK, with a third located in London, and generates a gross income of £14.1 million annually.

The industrial sector remains in good stead, with Q4 investment reaching £3.1 billion. Volumes have outperformed the previous quarters of 2020 and are up by a fifth on Q4 2019, reinforcing the continued strong investor sentiment for the sector. The largest deal of the period, the Platform portfolio, was acquired by Blackstone Real Estate from ProLogis UK for £473 million and comprises 4.3 million sq ft across 22 buildings located primarily in the Midlands and across the South West and North West of England and an additional 31 acres of development land. There were four other deals which crossed the £100 million mark, including three national portfolio transactions, and the sale of Electra Park in East London. The latter was acquired by SEGRO for £133 million, generating a 2.58% net initial yield.

Investment in the retail sector continues to reflect the ongoing structural shifts on the high street, which are being accelerated by the pandemic. Despite this, however, the sector has shown some resilience during the final quarter of 2020. Close to £1.5 billion was acquired in Q4, up by 8% over the quarter and 5% on Q4 2019.

Mixed-use and alternative property acquisitions collectively totalled £1.2 billion in Q4, down by about 5% on Q3 and close to 50% below the five-year quarterly average. The quarter’s figure was largely bolstered by the acquisition of the Nova Estate in London, SW1, purchased by Suntec REIT, a Singaporean-based investment trust, for £430.6 million, giving them a 50% interest with the Canada Pension Plan Investment Board. The estate comprises two office and leisure buildings (Nova North and Nova South) and a predominately residential building (The Nova Building) totalling 569,000 sq ft.

The hotel and leisure sector has been particularly hard hit by the pandemic, with only £76.1 million transacted in Q4. Although this is almost double that for Q3, investment is far from the highs seen in previous years – between 2015 and 2019, a quarterly average of £1.5 billion was being achieved. Birmingham was home to the largest deal of the quarter, the £38 million acquisition of 2 Exchange Square by LaSalle Investment Management, with the property anchored by a 235-bed Premier Inn hotel, and including a 6,000 sq ft restaurant and a 5,000 sq ft retail unit. Another deal of note was the £8 million purchase of Lansdown Grove Hotel in Bath by UK-based investor The Axcel Group. The vendors were private individuals, represented by Carter Jonas.

Overseas investors accounted for 57% of the total investment value in Q4 2020 – the highest proportion since Q1 2020 where the rate reached 70% - and accounted for a similar 58% over the whole year. As evidenced in the sector commentary above, many overseas purchasers contributed to the big-ticket acquisitions during the quarter, resulting in this increase.

In Q4, buyers from the Far East were the most active, investing approximately £1.8 billion into the UK’s commercial property market, a large portion of which include the aforementioned 1 & 2 Ludgate Hill deal and the UK Government offices portfolio acquisition. However, when looking at year-to-date figures, US purchasers have invested the most (£7.6 billion), followed by Far Eastern investors (£4 billion). This compares with £9.1 billion and £5.2 billion invested by each group respectively in 2019.

UK property companies traded close to £1.7 billion in Q4, followed by institutional investors who purchased circa £1.2 billion. Taking 2020 as a whole, these figures were £5.8 billion and £3.7 billion respectively, forming half of the 42%, or £19.5 billion, invested by domestic buyers in 2020.

The London investment market finished 2020 on a high, with strong demand for high quality opportunities. £4.8 billion was purchased across Greater London in Q4, accounting for 36% of the annual total, and in line with the 5-year quarterly average. Taking central London, £3.9 billion was transacted in Q4, accounting for 43% of the 2020 total.

Deals included the aforementioned 1 & 2 New Ludgate and Nova Estate purchases. Furthermore, office building 1 London Wall Place, EC2 was sold to overseas investor AGC Equity Partners for £472 million (3.85% net initial yield), while 158-159 New Bond Street (retail) was acquired for £310 million by occupier Chanel International at a 2.5% net initial yield.

Overseas interest is strong, particularly from European and Far Eastern buyers, despite the ongoing travel restrictions, with London pricing being more attractive than the returns offered in other European Capitals. This demand should further increase in the second half of the year as travel restrictions are hopefully eased, and the longer-term outlook for office occupier demand becomes clearer.

Pricing has held firm, particularly for prime buildings in Central London, and is, in some cases, reaching close to pre-COVID-19 levels. Given this, it would also appear some sellers, concerned about an uncertain outlook, are looking to cash in. However, there will continue to be a lack of quality assets relative to demand, adding to the upward pressure on pricing.

To find out more about our commercial property experience, please click here.

For further information on the investment market, please contact a member of our team.

Footnotes:

- Data has been sourced from a variety of platforms, including Property Data, CoStar, Radius and in-house databases.

- Data includes deals in the office, retail, industrial and alternative property sectors and excludes residential schemes and land deals.

- Data correct as at 4 January 2021.