- Date of Article

- Apr 18 2017

Keep informed

Sign up to our newsletter to receive further information and news tailored to you.

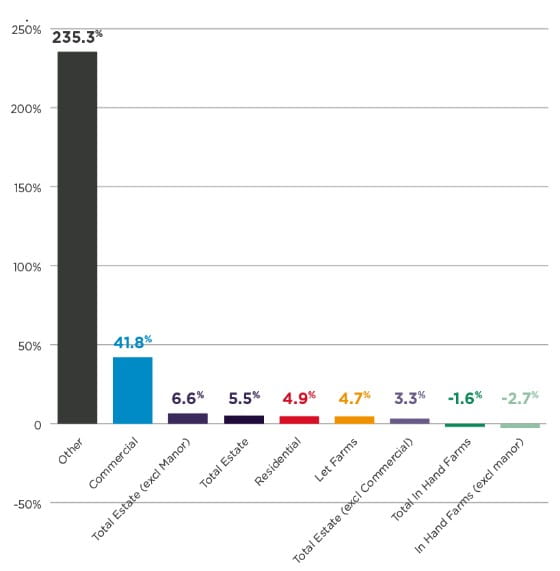

As the rural sector enters a new phase in the market cycle, findings of new research by Carter Jonas, the UK property consultancy, suggest estate diversification is key in supporting rural portfolio growth. Now in its eight year, the value of the Model Estate, an annual research report analysing the performance of a 3,168 acre notional agricultural estate, increased by 5.5% to £40.7m over 12 months to 31 December 2016. This is despite easing land values and uncertainties surrounding the EU referendum impacting the market.

The Model Estate tracks annual performance of its various components, which includes a Grade II listed manor house, let and in-hand farms, a commercial and residential portfolio, and the ‘other’ category, comprising a telecoms mast, fishing rights, a syndicate shoot and a solar farm.

In 2016, the addition of a solar farm, following an agreement with a renewable energy developer, caused the ‘other’ component of the Estate to surge in value by 235.3%. This reinforces that agricultural assets could experience a new era of buoyancy, if the potential of solar energy is harnessed as a means of diversification.

The commercial element also enjoyed impressive growth, increasing in value by 41.8%. This was due to active commercial management and regearing of the portfolio during the year.

Despite uncertainty following the Brexit vote, improvement in the rural office sector was considerable during 2016, with increased demand for both office and storage space recorded, which has led to an uptick in achievable rents and longer lease terms being agreed. This provides a marked contrast to the Central London and principal regional office markets, where the impact of Brexit on the market is more pronounced.

Recording growth of 4.9% and 4.7% respectively, performance of the Estate’s residential and let farm components was largely in line with the UK market sentiment. The nationwide uncertainty around UK house price growth continues and affordability is a key restraint, fuelling demand for rental properties. Within the let farms, agricultural rents remained static, with the increase wholly driven by a rise in the value of the houses and cottage, reinforcing the benefit of residential properties in rural portfolios.

While the manor house has historically proved a drag on performance, this year, it had a positive impact upon the in-hand farms. When the house was included, capital growth improved to – 1.6%, compared to -2.7% when it was excluded.

When benchmarked against the other asset classes, the performance of the Estate ranked fifth in 2016, ahead of UK commercial and residential property. However, over a longer-term period, the growth rate of property, including the Model Estate, displayed more stability, in comparison to equities and gold prices, for example, which have shown more volatile trends.

Tim Jones, Head of Rural, Carter Jonas, said:

“This year’s Model Estate reinforces the need for landowners to commit to strategic asset diversification to help safeguard against the effects of economic and political uncertainties. While investment in rural land, and property more widely, remains challenging, it will nonetheless remain an attractive proposition.

“The Model Estate research demonstrates that well managed estates still have significant potential for capital growth, whether through investment in renewable energy, the conversion of existing buildings or the promotion of alternative assets.

“The triggering of Article 50 will put the rural sector to the test, and landowners, farmers and tenants will need to keep a close eye on the situation as policies develop, to seek out future opportunities.”

Catherine Penman, Head of Rural Research at Carter Jonas, concluded:

“Following the UK’s vote to leave the EU there are a number of cooling headwinds facing the UK’s farming industry, including uncertainties surrounding the subsidy regime and trading arrangements. Even so, one of the key attributes of agricultural land is its counter-cyclical nature and whilst the recent pricing correction of the land market was inevitable following so many years of sustained growth, sentiment in the rural sector should remain robust over the next 12 months.”