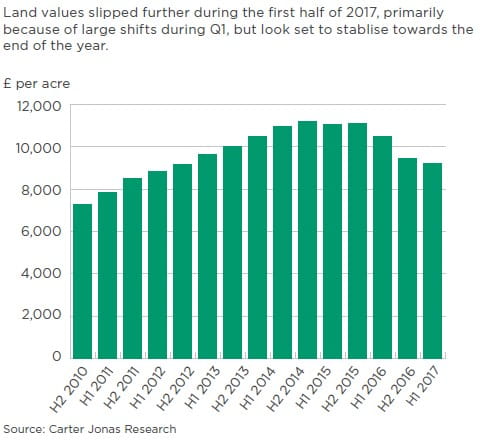

Farmland values across the UK showed minimum movement in the second quarter (Q2) of 2017 according to new data from Carter Jonas, the national property consultancy.

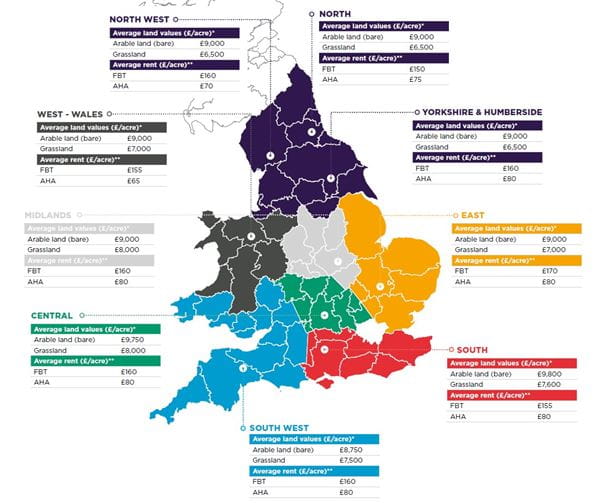

After falling significantly during the summer and autumn months of 2016, average arable land values are now recorded at below £10,000 per acre across the whole of the UK. Values remained the highest in Southern and Central England, where demand for arable land is most prominent.

While sales activity in Q2 was relatively quiet, transactions are still taking place, despite continued uncertainty in the sector. Hotspots in each region are still evident, and the lack of supply in the most sought-after areas is one of the key factors in stabilising land values.

Vendors are choosing to keep their assets in whole lots, which traditionally have proved more difficult to sell, due to their higher price tags. Compared with three years’ ago, stock is remaining on the market for longer periods of time, with discerning buyers still unwilling to rush into a purchase, choosing instead to hold out for the ‘perfect farm’ that will meet all their requirements.

In terms of finance, there is evidence to suggest bank lending for the agricultural sector is increasing, and that lenders are willing to support businesses that can service the debt, with a good track record, and a robust business plan.

Tim Jones, Head of Rural, Carter Jonas, comments;

“The second quarter of 2017 has seen the market react to a great level of uncertainty and, as a result, the correction in land values is to be expected. Following the recent government pledges on support, it is vital that the agricultural sector prepares itself for the changes that lie ahead, and remains innovative and adaptable in the face of uncertainty.”

Andrew Fallows, Head of Rural Agency, Carter Jonas, comments;

“In a polarised market, land values are under pressure; quality counts for everything, and location is as vital as ever. While there’s a fair degree of uncertainty, the agriculture sector as a whole has proven to be resilient, and we’re seeing a sturdy market correction that is benefitting, in the short term, from an increase in output commodity prices.”