The Oxford to Cambridge Arc is the strategic tool for delivering growth and providing wider social benefits. Given that it is based on transport infrastructure that will take many years to complete and with uncertainty surrounding this, we believe that a greater utilisation of development along existing corridors should be considered.

Looking at the geography of the Arc, four existing corridors stand out as having potential. These are:

- the M4 corridor from Oxford to Swindon, Bath and Bristol. This route uses the A420 from Oxford to Swindon, which is currently single carriageway, but could potentially be upgraded. There is also the potential for a fast rail connection. Currently, the journey from Oxford to Bristol takes circa 90 minutes, involving a change of train. However, the infrastructure already exists to run direct trains, which could do the journey in under 70 minutes.

- the M40 corridor from Oxford and Bicester to Birmingham and Coventry. The M40 provides a drive time from Oxford to Coventry of 60 minutes and 78 minutes to Birmingham. The current rail time is relatively slow at 50 minutes to Coventry and 70 minutes to Birmingham.

- the M1 Corridor from Milton Keynes to Northampton, Coventry and Leicester. The corridor also runs south to Luton and Hemel Hempstead. The corridor benefits from excellent road and rail connections, with Milton Keynes to Coventry achievable in just 30 minutes by train and 50 minutes via the motorway.

- the M11 / A1(M) corridor from Cambridge southwards to Harlow and northwards to Peterborough. Southwards, the M11 provides an excellent road connection to Bishop’s Stortford and Harlow. Northwards, the A14 north link is also excellent due to the completion of the A14 scheme west of Cambridge providing a three-lane carriageway to the A1. Both Peterborough and Harlow can be reached in a little over 40 minutes.

The existing corridors

The accessibility of the four existing corridors is favourable when compared with the existing journey times across the Arc from Oxford to Cambridge, and even with the timings which could potentially be achieved with the proposed East West rail link.

Figure 15: Distance and time travel comparison

Which economic centres and corridors have the most potential for residential and commercial development?

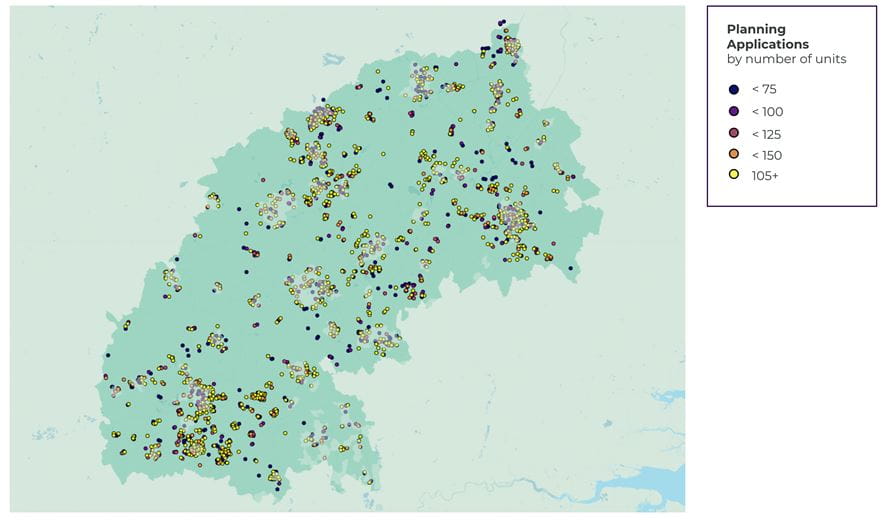

Residential

The residential pipeline (applications rather than those with planning permission) is more widespread than both its office and industrial equivalent which is to be expected. The planning pipeline of schemes in south Oxfordshire, central Bedfordshire, east Northamptonshire, Milton Keynes and south Cambridgeshire are all above 9,000 units each. At the other end of the scale, there is a distinct lack of pipeline in nine Local Authorities, including Oxford and Cambridge, although as previously mentioned due to tightly drawn boundaries neighbouring districts have assisted in helping to meet both cities’ housing needs.

Figure 16: Housing market scale comparison

Figure 17 – Location of proposed residential developments

Source: Glenigan

Industrial

Development opportunities exist along the Oxford Cambridge corridor, and the logistics market, in particular has seen a rise in development activity in the last five years. In terms of future development pipeline for the sector, the Corby, Northampton, Bedford, Wellingborough and Kettering zone offers the highest number of opportunities as although they have witnessed considerable development in recent years, they are still relatively youthful (and land values are cheaper) in comparison with the more established centres of Oxfordshire and Huntingdonshire.

Offices

Unlike the logistics sector with an obvious zone of opportunity, the office sector’s pipeline is more scattered, with the traditional centres of Cambridge and Milton Keynes offering a meaningful although long-term, pipeline as well as the more outlying areas including Peterborough. However, Luton offers the highest development opportunities by a considerable margin.

Figure 18: Commercial market scale comparison

Conclusion

There is no magic bullet for enabling growth, and all of the options will have a part to play. However, there is significant potential to provide development along existing transport corridors to Arc locations which do not require considerable new infrastructure and could be delivered in a much shorter timeframe than the east-west corridor.

In addition, significant synergies exist between the Arc’s economic centres and those along existing corridors including the skilled workforce, which is focused on the knowledge-based industries rather than the logistics market, similar earning capability and socio-economic profile. This crossover should not be understated as it is entirely possible that people would consider relocating from the existing corridors to the Arc if the appropriate role and renumeration package were available as well as the provision of suitable housing.

Colin is a Partner and was appointed Head of Planning & Development Division in November 2020, he is based out of our Cambridge office. He has over 25 years’ experience of planning consultancy and has a broad sphere of work. He acts for a wide range of private, institutional and developer clients and has worked on significant planning applications and appeals.

Scott specialises in providing advice on agency and development matters to a wide variety of clients from private individuals and trusts through to property funds, institutions, companies and statutory authorities. He advises both owners and occupiers across public and private sectors.

Working at Board level with clients, Scott’s specialist areas include Business development, development of property strategies, property investment advice, advice in the marketing and disposal of property as well as property acquisitions.

Scott has a particular knowledge and understanding of the property market in the wider Oxfordshire region whilst also operating on a national basis on specific projects.